The Kansas City industrial real estate market has been on a historical run since 2020 with over 40 million square feet of inventory added in that time frame. This run of new construction has catapulted Kansas City to the 15th largest industrial market in the country by square footage, despite only being the 31st largest MSA by population.

During most of this period, the strong market dynamics which exist in Kansas City, such as strategic highway infrastructure, a centralized location, four Class-1 railroads, availability of bulk land sites and an active development community, were further amplified by the low-interest rate climate and record levels of tenant activity. The continued high pace of speculative industrial construction starts in 2022 positioned 2023 to experience a healthy amount of new deliveries, with almost 8 million square feet of speculative industrial space delivering to the market.

While the financial markets presented opportunity during this run of growth, continuous rate hikes in 2023 created challenges that resulted in a significant decrease in year-over-year speculative construction starts (3.5 million square feet of speculative construction has occurred year to date in 2023 as compared with more than 13 million square feet in 2022) as developers’ cost of construction financing skyrocketed.

From a standpoint of tenant demand, net absorption in 2023 (4.1 million square feet as of the third quarter of 2023) did not reach the highs of the previous year (15.6 million square feet in 2022) but remained well above pre-pandemic levels (1.2 million square feet in 2019). The tenant demand pipeline remains strong and diverse, with Newmark Zimmer currently tracking nearly 14 million square feet of active industrial tenant requirements, which is significantly higher than the amount of Class A space that will be available in the first quarter of 2024.

Notable users to Kansas City in 2023 included Nuuly, Chick-fil-A, Ace Hardware, Cnano Technology USA, Standard Motor Products, US Motor Works and Community Wholesale Tire. These users are prime examples of the industries that continue to drive growth in Kansas City such as automotive, e-commerce, manufacturing, and food & beverage.

Construction continues to progress on Panasonic’s $4 billion battery plant in De Soto, Kansas, which is the latest example of nearshoring as a result of challenges brought about by the COVID pandemic. Flint Development’s nearby Flint Commerce Center was the recipient of an adjacent business line of this megaproject, with Panasonic Energy taking 509,760 square feet in the park’s 1 million-square-foot first building.

Ace Hardware’s announcement of its new 1.5 million-square-foot Retail Support Center at Hunt Midwest’s KCI 29 Logistics Park in Kansas City represents the first groundbreaking of its 20 million-square-foot industrial and commercial development.

As the speculative construction pipeline remains low compared with recent years, the 4.9 percent vacancy rate in the third quarter of 2023 (which was somewhat inflated due to large speculative deliveries), will likely decrease, resulting in a near-record low vacancy rate as tenants take space off of the market in the first half of 2024.

While there is confidence that interest rates will remain stable or pull back in 2024, new speculative construction starts will remain few-and-far-between for the time being. On the plus side, much of the construction that will take place will be a result of build-to-suit requirements for specialized users, many of which will have a manufacturing component.

The aforementioned Flint Development project with Panasonic Energy, as well as Hunt Midwest’s 530,000-square-foot lease to LKQ at Heartland Logistics Center’s 852,000-square-foot Building 3, are examples of developers greenlighting construction of larger facilities after pre-leasing a portion of the space. This trend should continue with other developments and will represent a large portion of new available Class A industrial space coming on the market in 2024.

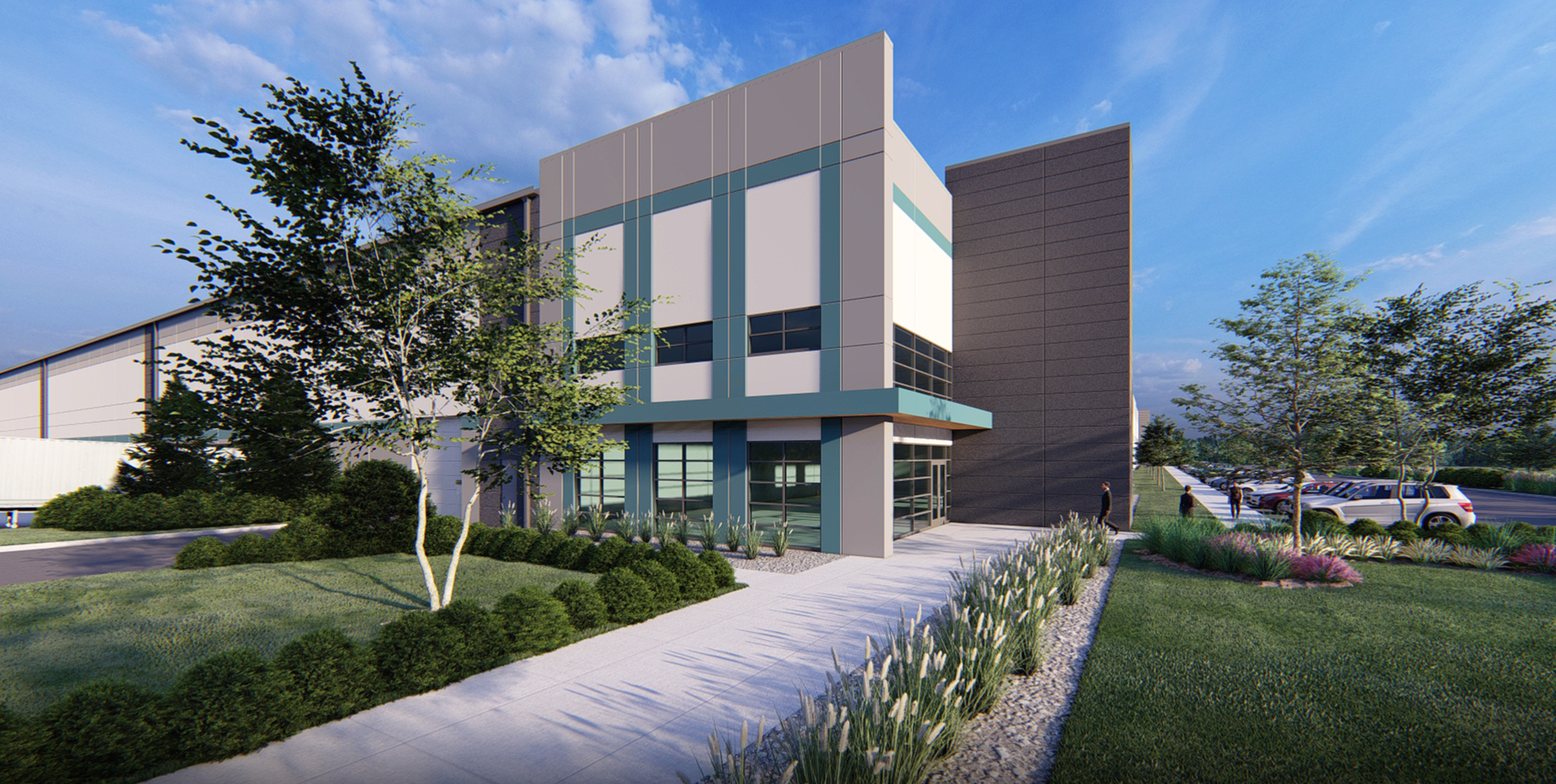

When evaluating the industrial projects that are either planned or announced around metro Kansas City (such as NorthPoint’s North Liberty Logistics Center, Hunt Midwest’s KCI 29 Logistics Park and Scannell’s Compass 70 Logistics Park and 435 Logistics Park), there is confidence in the ongoing health of the market due to the experienced and capable developers controlling strategic sites that can accommodate a wide range of sizes, uses and designs.

As the debt markets stabilize, these future developments will allow the Kansas City metro area to continue to accommodate the needs of growing businesses with local footprints while also attracting new entrants and investment into the region in 2024 and for years to come.

Article by John Faur. John Faur is an associate director with Newmark Zimmer. This article originally appeared in the January 2024 issue of Heartland Real Estate Business magazine.